New Delhi, Feb 10, 2025-

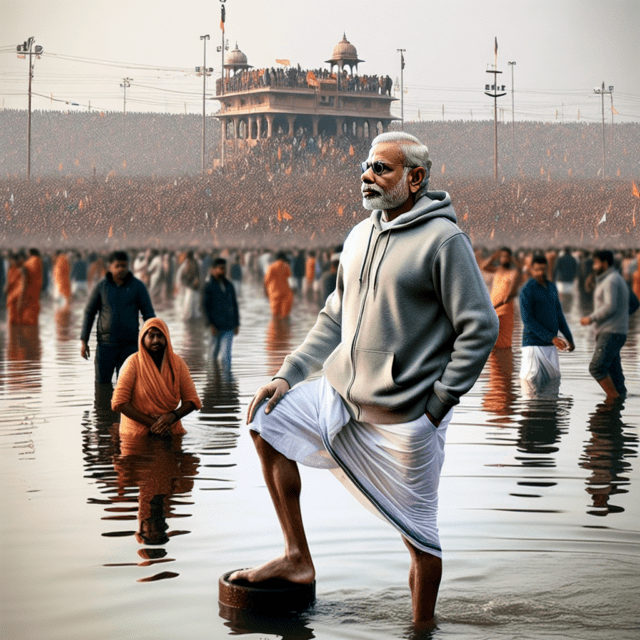

President Droupadi Murmu visited Prayagraj on Monday to take part in the ongoing Maha Kumbh Mela, where she took a sacred dip at the Triveni Sangam.

Upon her arrival, President Murmu was welcomed by Uttar Pradesh Governor Anandiben Patel and Chief Minister Yogi Adityanath. She is to spend over eight hours in Prayagraj, immersing herself in the spiritual and cultural grandeur of the Kumbh Mela.

Before taking her holy dip, the President fed migratory birds at the Sangam, reflecting her reverence for nature.

Following the sacred ritual, President Murmu is scheduled to visit the Akshayavat tree, an ancient symbol of immortality and divine presence in Sanatan culture. The tree holds a revered place in Hinduism and is mentioned in ancient scriptures as a source of eternal life.

She will also offer prayers at the historic Bade Hanuman Temple, seeking blessings for the prosperity and well-being of the nation.

In addition to her religious engagements, the President will explore the Digital Maha Kumbh Experience Centre, a modern facility that uses advanced technology to give both domestic and international visitors a virtual experience of the Kumbh Mela.

The security arrangements across the city were heightened in light of the President’s visit. This visit is historic, as it follows the footsteps of India’s first President, Dr. Rajendra Prasad, who had also taken a holy dip at a previous Kumbh.

After completing her spiritual journey, President Murmu will return to New Delhi by 5:45 P.M., concluding her visit to the Maha Kumbh in Prayagraj. This visit enhances the cultural and spiritual significance of the event, making it an inspiring moment for all devotees.(Agency)