This is the typical amount of time to ensure that the money you deposit into your account’s checking account is accessible to you. It’s not the only thing to consider. Depending on the kind of deposit you deposit, you might be able to access your cash in a matter of minutes, or be waiting longer than two days.

It’s all about the individual. Therefore, prior to making any transfer or withdrawal you should know everything you can about your Bank’s policies on funds availability . If you don’t, you could be penalized with an unpleasant “insufficient funds” fee. Here’s a quick summary of the process of obtaining funds. Know about v5 hold.

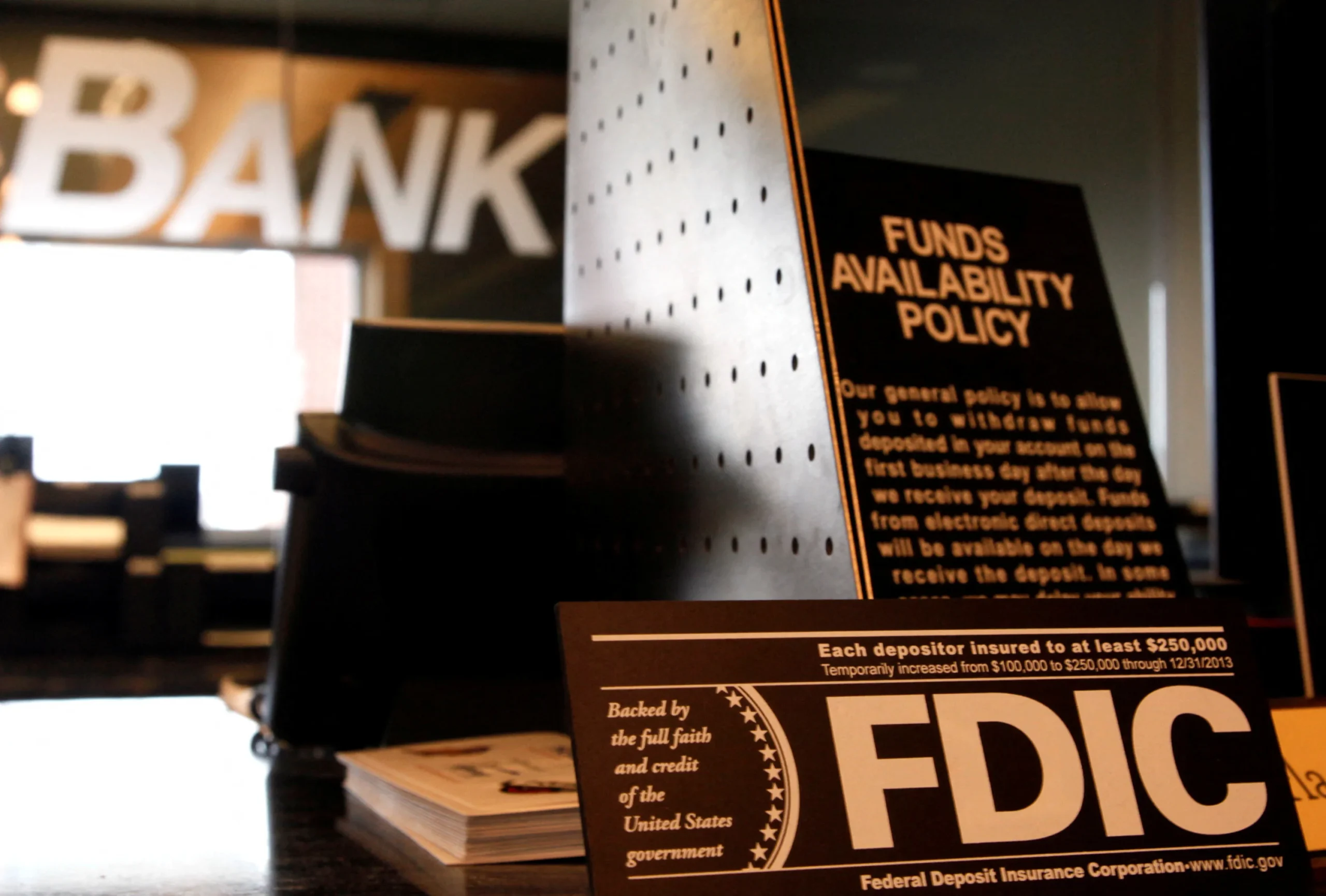

What is bank funds availability?

Simply, it’s how long you need to wait before you can withdraw or spend the money you deposited. The federal government provides banks with guidelines on this period which banks employ them to develop their own policies on availability of funds.

Banks will provide you with their policy when you sign up for a checking account. It may seem small, but it’s still worth studying. If you’re not sure about certain things, don’t hesitate to inquire with your bank representative any questions. In this way, you’ll understand what the regulations are, so that you can better prepare the budget and complete transactions when the funds are available.

When can you anticipate the funds to be accessible?

It is based on the type of money you deposit to your account. There are several variables to consider.

Hours of operation

Most banking deposits will be processed during working days (Monday-Friday) and each bank has a cut-off time to ensure that deposits are valid for that day’s business. Reviewing the bank’s policies may be helpful as well or, better yet you can visit their website or contact them by phone for any inquiries.

Type of deposit

Direct deposits and cash are typically available on the same day. Most banks make checks available within a couple of days.

Sum of deposit

The larger deposits that exceed $5,000 generally take longer to be cleared. Your bank could even make a part of it available earlier.

History of a bank

If you’re a new client the bank may hold your account for longer than when you were a previous customer (at least initially). This is merely a security measure. It’s not hurt to inquire about the bank’s policies on availability of funds when you first open your account.

Why wouldn’t you get immediate access to your funds?

You earned it. It’s yours. So , why is there a wait? Banks hold money due to a number of reasons however none is designed to cause inconvenience.

A waiting time of a few days is common when you need to make your money available. It’s usually a result of money that is deposited into your account in the form of checks. This waiting time is for a reason to confirm the amount of money that was deposited. It may feel as a hassle however, it allows banks the chance to verify that everything is in order, which is beneficial for their customers as well.

If you’re ever unsure regarding whether your money is available make contact with your bank for an accurate picture. Being informed about the condition of your deposit straight from them can help you organize your budget and relax at ease. Peace of mind — it’s invaluable.

Two business days. This is the typical length of time to ensure that the money you deposit into your account’s checking account actually gets to you. It’s not the only thing to consider. Depending on the kind of deposit you deposit, you may be able to access your funds in a matter of minutes, or be waiting longer than two days.

It all depends on. Therefore, prior to making any transfer or withdrawal you should know everything you can about the bank’s policies regarding funds availability. In the event that you don’t, you could be hit with an unfun “insufficient funds” fee. This is a brief overview of how the availability of funds works.

What exactly is money availability?

Simplyput, it’s the time you have to be patient before you are able to take out or use the money that you have deposit. The federal government offers banks guidelines regarding this period and banks can employ them to develop their own policies on availability of funds.

Banks will provide you with their policy when you sign up for a checking account. It may seem small, but it’s still worth studying. If you’re not sure about the subject, don’t hesitate asking your banking representative for clarification. So, you’ll be aware of the rules so you’ll be able to better prepare your financial plan and complete transactions when funds are made available.

Stay tuned to Centralfallout for the latest scoops and updates of Latest News, Trending News, Technology News, World News and Entertainment News.